Advice to Advisors: Buy Japan, Hold U.S., Sell Europe

Recent data suggests economic conditions in Europe are deteriorating, removing a key element of LPL Research’s positive view of the attractively valued developed international equities asset class. Previous U.S. dollar weakness and strong earnings momentum, which were other key reasons why we became more interested in European investing earlier this year, have reversed and suggest looking elsewhere for investment opportunities. Another international market to consider is Japan, which is also attractively valued with better fundamentals than Europe, in our view.

Outlook for Europe is Worsening

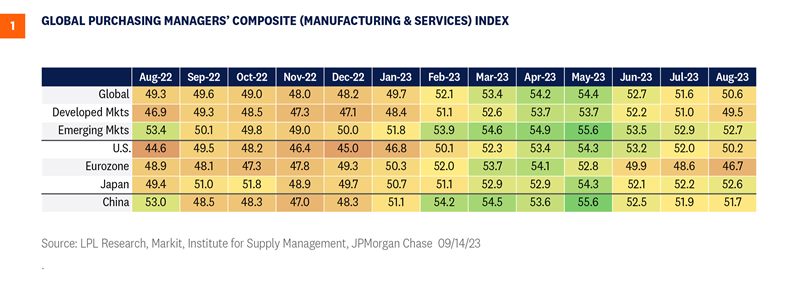

Recent data in Europe, such as the purchasing managers’ index (PMI) data, shows that the European economy is weakening. In fact, the Eurozone Composite PMI in August reflected the deepest contraction in nearly three years, while nearly every economy in the region reported weaker readings, led by Germany. As shown in Figure 1, the Eurozone Composite PMI fell to 46.7 in August, the fourth straight monthly decline and below the U.S. (50.2), Japan (52.6), and even China (51.7).

Turning to a more commonly used economic measure, Eurozone GDP for the second quarter was revised down to a 0.1% expansion from the previous 0.3% estimate, which pales in comparison to what the U.S. (+2.1% annualized) and Japan (+4.8%) produced during the second quarter. So, while growth is also expected to slow in the U.S. and Japan, Europe has much less economic momentum to help carry the region through the next six to 12 months as the impact of tighter monetary policy is increasingly felt. As a result, economic activity in the Eurozone will likely be subdued for the rest of the year and into 2024.

Getting more granular and taking a look at individual countries, we see the outlook is hazy for countries like the United Kingdom (U.K.) and Germany. The U.K.’s economy contracted 0.5% month over month in July. This pace of contraction is the worst seen in seven months, with every major sector of the economy declining during the month. Although still suffering from prolonged inflation and higher borrowing costs, labor action took a heavy toll as education and health employees went on strike. Investors should know that such a sharp contraction raises the possibility of a potential recession in the U.K. as 2023 draws to a close.

Moving over to Germany, the ZEW Economic Sentiment Index showed investors are still not confident in an economic turnaround in the next six months. September’s index fell to -11.4, well below the 0 threshold that separates bullish and bearish sentiments. Investors cited instability caused by conflict and unusual climate episodes, as well as inflation and decreased manufacturing output. Near-term risks are rising for the biggest economy in Europe.

Global central bankers are in a tough spot, but among major central banks, none look tougher than the job facing Christine Lagarde at the European Central Bank (ECB). Inflation remains stubbornly high in Europe, which triggered the ECB’s decision to hike rates a quarter point on September 14—its tenth straight meeting with a rate hike—despite the sluggish economy.

Meanwhile, U.S. markets are still unsure if the Federal Reserve (Fed) is completely done, but unlike Europe, the domestic economy remains resilient, and U.S. inflation is on a better trajectory than its European counterparts. Meanwhile, Japan’s economy grew like gangbusters the past two quarters, and the Bank of Japan (BOJ) has barely started withdrawing its accommodative monetary policy. The BOJ has signaled its intention to remove its yield curve control (YCC) program, but the timetable is uncertain.

Europe faces energy, labor, and geopolitical headwinds and lacks the innovation engine that can propel stronger growth like the U.S., and, to a lesser extent, Japan, enjoys.

U.S. Dollar may be about to break out to the upside

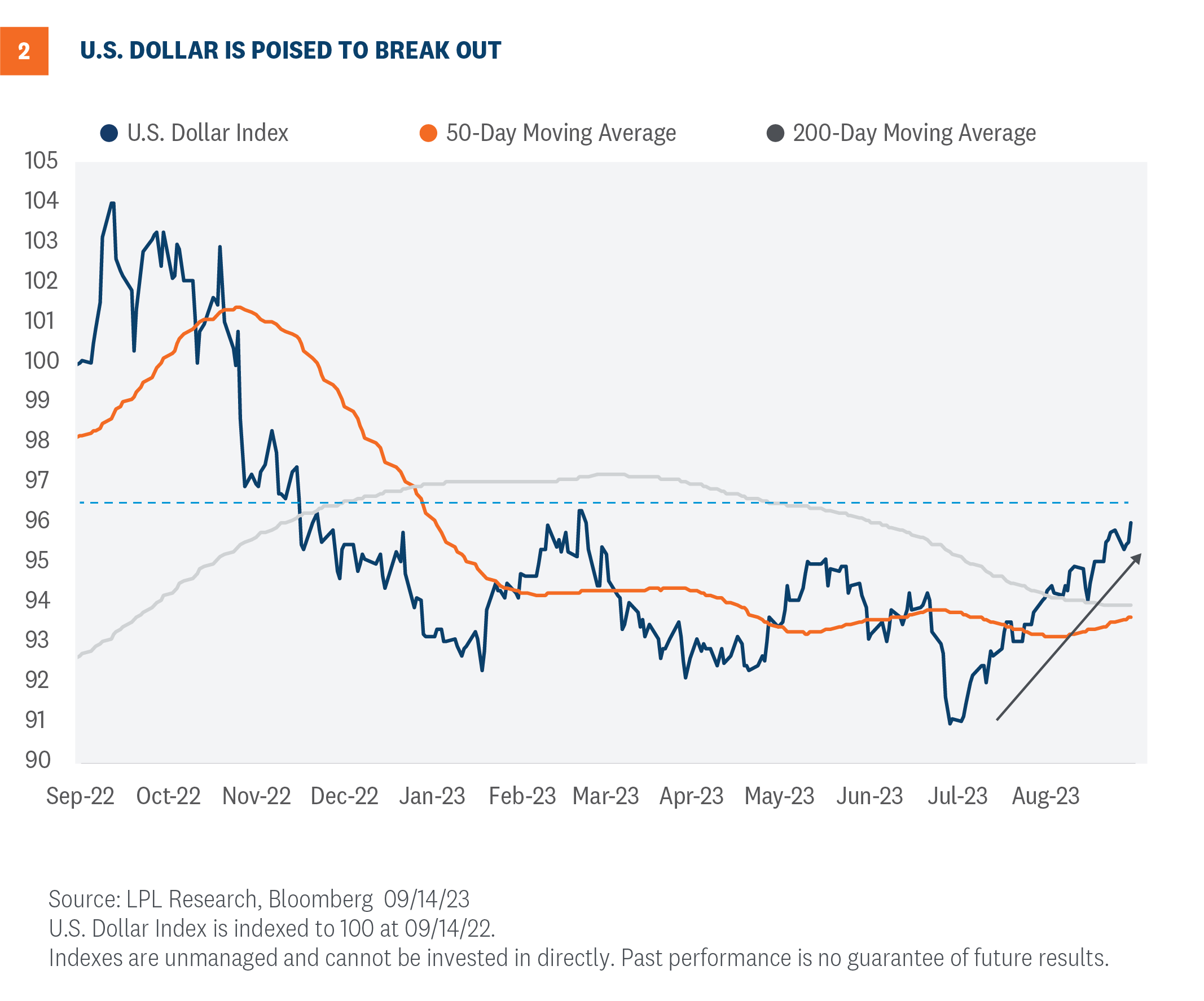

A negative call on the U.S. dollar has gotten tougher to make. The US Dollar Index is up more than 5% off its recent July 14 low, an impressive recovery after a double-digit decline from the September 2022 highs. Dollar strength reflects the stronger-than-expected U.S. economy, higher-for-longer monetary policy from the Fed, as well as euro weakness related to its slumping economy, all of which have contributed to the U.S. reasserting itself as a more attractive investment destination.

Now, the ECB’s rate hiking cycle may potentially be over before the Fed’s, which means the interest rate differential that we had expected to push the euro currency higher against the dollar has not done so. In fact, markets may increasingly start pricing in rate cuts in Europe, removing the ECB-Fed interest rate differential as a possible bearish dollar catalyst. Also consider that as the global economy likely slows in the months ahead and markets potentially become more volatile, the greenback may get a safe haven bid.

Finally, from a technical analysis perspective, the dollar appears poised for a breakout to the upside through a major level of resistance to potential new 2023 highs (Figure 2).

The other side of the story is European exporters should garner some support from a weaker currency (making their goods more attractive to U.S. buyers). Regardless, even though the case for USD weakness over the intermediate and longer term looks like a strong one, our conviction in calling a short term dollar decline is low, removing a potential boost for European equities.

Europe's Earnings Momentum is Waning

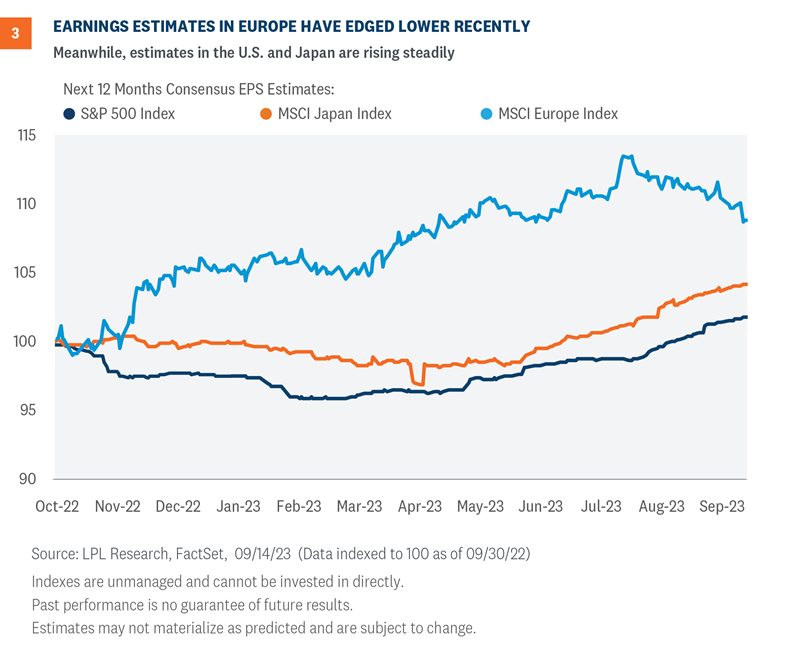

Europe’s economy outpaced most expectations in late 2022 and early this year amid fears of an escalating energy crisis as the war in Ukraine continued. Rising earnings expectations coincided with that outperformance, at least until this summer. Since July, however, earnings estimates have fallen, coinciding with recent ratcheting lower of economic growth expectations in the region (Figure 3).

With recession increasingly likely in Europe in the near term, particularly in Germany, the current consensus expectation for 6% earnings growth from MSCI Europe in 2024 may be too high—though we acknowledge the 12% earnings growth reflected in S&P 500 consensus is also too high. Regardless, we would anticipate the U.S. and Japan delivering stronger earnings growth than Europe over the rest of this year and in 2024.

Valuations Favor Europe, but Japanese Equities are Cheap Too

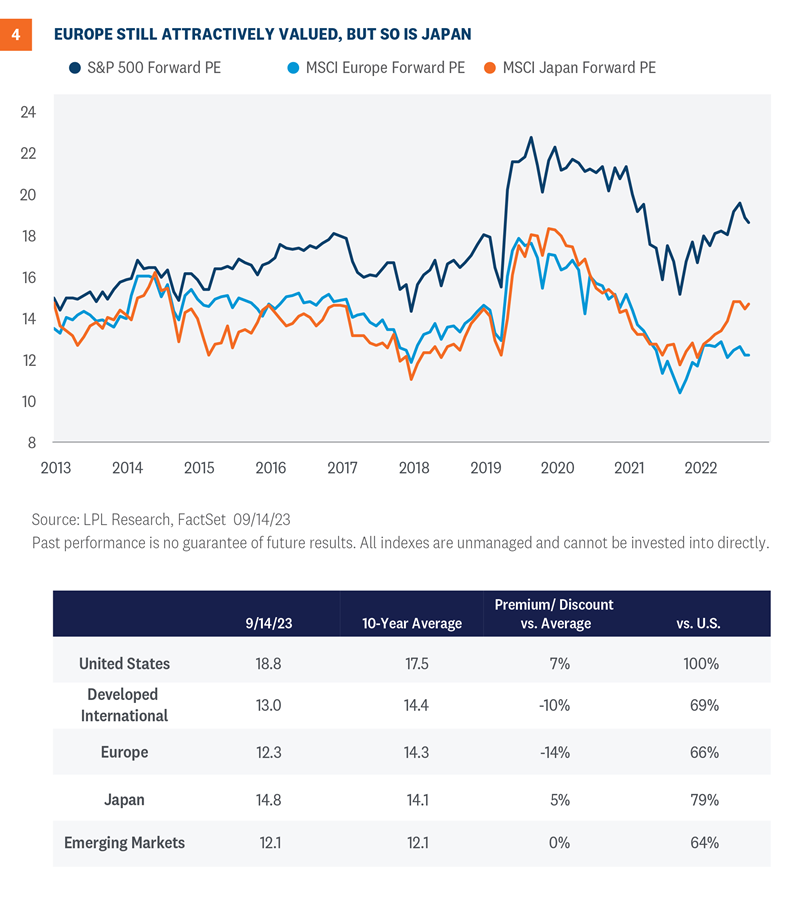

The primary reason LPL Research has slightly favored developed international equities has been their attractive valuations. European stocks compose most of the MSCI EAFE Index benchmark we use for the developed international equity asset class and, at a price-to-earnings ratio (P/E) near 12, are even more attractively valued than Japan (14.8) or the broad index (13).

But as shown in Figure 4, Japanese stocks are also attractively valued, even at a higher P/E ratio. While Japan’s P/E is slightly higher than its 10-year average, it is more than 20% cheaper than the U.S., which is a large discount for a market where companies are increasingly focused on creating shareholder value. In fact, earlier this year the Tokyo Stock Exchange even warned Japanese-listed companies to get their price-to-book value ratios up by focusing more on adding shareholder value, which should lead to companies putting excess cash to work and, over time, improve valuations. Also consider this valuation gap between Europe and Japan closes some when adjusted for sector mix.

Importantly, Europe’s sector mix has much less technology, making it difficult to keep up with the U.S. The MSCI Europe Index has just a 6.6% weighting in technology, compared to more than four times that amount (27.7%) in the U.S. Although the technology sector’s 40% year-to-date rally may be a bit overdone, in rising markets it’s tough for European markets with a more defensive sector mix to keep up.

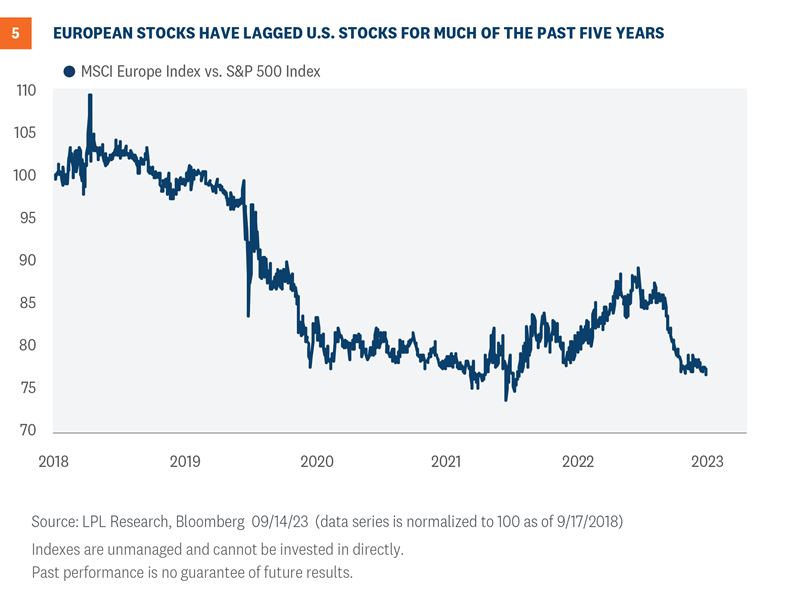

The Charts in the U.S. and Japan Generally Look Better

From a technical analysis perspective, Japan and U.S. equity markets look better than Europe right now. The relative strength of the MSCI Europe Index, shown in Figure 5 in local currency, has broken down and has not been able to generate any positive momentum (the Europe index in dollar terms looks very similar). Japan, on the other hand, in yen terms, has been generating some nice outperformance recently against the U.S. and Europe, with higher highs and higher lows. In fact, U.S. investors in Japanese markets that have hedged currency have generally done better this year than they have done in broad U.S. equities, based on the S&P 500.

Investment Conclusion

The investment outlook for Europe does not look as attractive as it did earlier in the year when the economy was outperforming expectations, the U.S. dollar was weakening, and earnings expectations were rising. Now, we have a weakening economy, a strong dollar, and waning earnings momentum. LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) still slightly favors developed international equities over the U.S. on the upbeat outlook in Japan, while maintaining an underweight recommendation for emerging markets (EM).

More broadly, the STAAC recommends a neutral tactical allocation to equities, with a modest overweight to fixed income funded from cash. The risk-reward trade-off between stocks and bonds looks relatively balanced to us, with core bonds providing a yield advantage over cash.

Within equities, the STAAC recommends being neutral on style, favors large caps over small, and suggests overweight allocations to the energy and industrials sectors, where appropriate.

Within fixed income, the STAAC recommends an up-in-quality approach with benchmark-level interest rate sensitivity. Core bond sectors (U.S. Treasuries, agency mortgage-backed securities (MBS), and short-maturity investment grade corporates) currently look more attractive than plus sectors (high-yield bonds and non-U.S. sectors), with the exception of preferred securities, which look attractive after having sold off due to stresses in the banking system.

Jeffrey Buchbinder, CFA, Chief Equity Strategist

Jeffrey Roach, PhD, Chief Economist

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. As interest rates rise, the price of the preferred falls (and vice versa). They may be subject to a call feature with changing interest rates or credit ratings.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered inv estment advisor and broker -dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment a dvice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |

RES-1627733-0823 | For Public Use | Tracking #479826 (Exp. 09/24)